Bi weekly mortgage calculator with additional payments

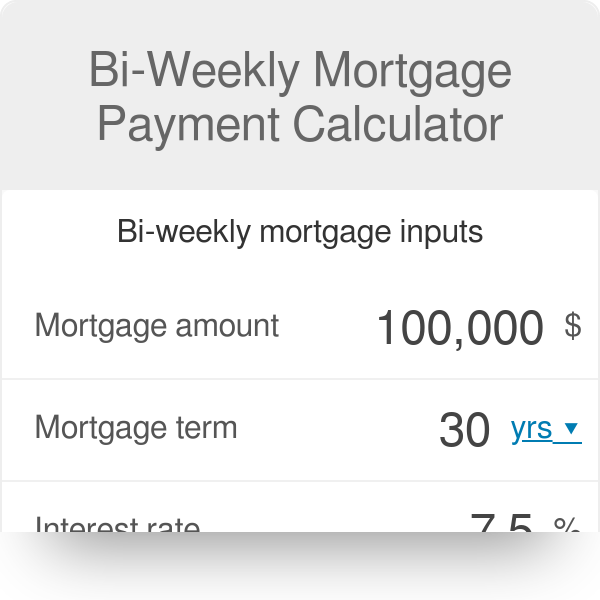

Bi-Weekly payments are mortgages that are paid every other week and the payment is half of the monthly payment. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Building a Safety Buffer by Making Extra Payments.

. Whatever the frequency your future self will thank you. By using an advanced calculator you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. With the bi-weekly mortgage plan each year one additional mortgage payment is made.

The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible. Make more frequent payments. Even just an extra payment of 20 per month can make a.

Plus nothing prevents you from combining bi. This once-a-month option is common and its convenient as these payments are made on the same day each month. Bi-weekly payments are another way to create the equivalent of a 13th month payment.

Winning with Bi-Weekly Payments. Bi-Weekly Payments Payments that occur once every two weeks. Balance at end of term planpay.

With bi-weekly payments you pay half of the monthly mortgage payment every 2 weeks rather than the full balance once a month. To learn more about other types of extra payments visit the extra payment mortgage calculator. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

As a result borrowers repaying bi-weekly make a full extra contribution to their mortgage repayment each year which gets applied directly to the principal balance of the loan. Bankrate is compensated in exchange for featured placement of sponsored products and. That extra payment goes toward the principal of the.

Bi-Weeklies True bi-weekly payment calculator Prints yearly amortization tables. If you have to pay PMI on a conventional loan instead of paying it every month along with your mortgage payment you can opt to pay for it upfront as a one-time fee. How we make money.

Interest The percentage rate charged for borrowing money. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Since there are 52 weeks in the year your total number of payments when paying bi-weekly is 26 which actually includes more payments than a monthly schedule.

The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. Principal is the mortgage amount you borrowed to buy your home minus what youve already paid back through monthly or bi-weekly payments. Mortgage insurance is only available when the purchase price is below 1000000.

Principal Amount The total amount borrowed from the lender. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. When most people buy homes using mortgage loans they make monthly payments.

Bi-Weekly Mortgage Payment Calculator Terms Definitions. Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount. If you pay half of your monthly payment 26 times a year its equivalent to making 13 monthly payments.

There are 52 weeks in a year which means there are 26 biweekly periods. You can avoid this additional monthly cost by putting 20 down on your home. Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt.

How to estimate mortgage payments. How Do Bi-Weekly Payments Work. If you want to immediately lower your payments bi.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Notice there is a big difference between paying twice a month and bi-weekly payments. Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs.

This is comparable to 13 monthly payments a year which can result in faster payoff and lower overall interest costs. Purchase price Down payment Amortization period number of years 1 Year 2 Years 3 Years 4 Years 5 Years 6 Years 7 Years 8 Years 9 Years 10 Years 11 Years 12 Years 13 Years 14 Years 15 Years 16 Years 17 Years 18 Years 19 Years 20 Years 21 Years 22 Years 23.

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Payoff Mortgage Refinance Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Downloadable Free Mortgage Calculator Tool

Bi Weekly Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Payoff